When a bond is issued at a price higher than its par value, the difference is called bond premium. There was no premium or discount to amortize, so there is no application of the effective-interest method in this example.

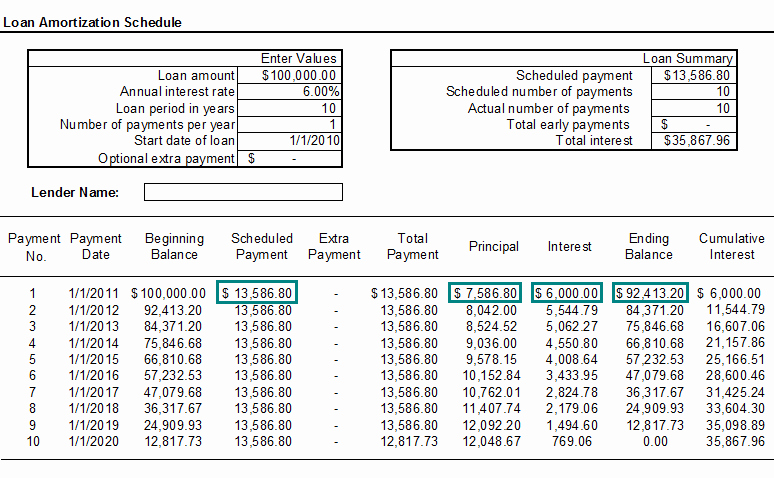

Assume a company issues a $100,000 Certified Public Accountant bond with a 5% stated rate when the market rate is also 5%. The price at which a company sells its bonds - and the resulting premium or discount - is an important factor, and it must be accounted for. The coupon rate a company pays on a bond is the most obvious cost of debt financing, but it isn’t the only cost of financing. If the company issues monthly statements, the bond’s amortization cost should also be calculated monthly. When the first payment is made, part of it is interest and part is principal. If you want an accurate, to the penny amortization schedule, you should spend a minute or two understanding these options. The schedule calculates the payment dates from the first payment due date. Payment Period or Frequency – how often do you want to schedule payments? The calculator supports 11 options, including biweekly, monthly, and semiannual.

0 kommentar(er)

0 kommentar(er)